Free Insurance: A Limited-Time Offer You Can’t Miss

In a world where uncertainties abound, having insurance can be a crucial safety net. Whether you’re safeguarding your health, protecting your family, or ensuring your assets, the right insurance can provide peace of mind.

That’s why we’re thrilled to share an enticing opportunity: Free Insurance for a Limited Time! This offer is designed to help you experience the benefits of insurance without any financial commitment. Let’s explore this limited-time promotion in detail and understand why it’s an opportunity you simply cannot afford to miss.

What Is Free Insurance?

Free insurance is a promotional offer from various insurance providers that allows eligible individuals to obtain certain types of insurance coverage at no cost for a specified duration. This could include:

- Health Insurance

- Life Insurance

- Auto Insurance

- Renters Insurance

The primary goal is to provide essential coverage while allowing you to assess the value of the insurance product without any upfront payment.

Why Take Advantage of This Offer Now?

1. Limited-Time Availability

Insurance companies often run promotional campaigns to attract new customers. These offers are typically time-sensitive, meaning they won’t last forever. By acting quickly, you can secure coverage that might otherwise be out of reach.

2. Financial Relief in Tough Times

With rising living costs and economic uncertainty, many individuals and families are looking for ways to cut expenses. Free insurance allows you to protect yourself and your loved ones without adding financial strain during difficult times.

3. Increased Awareness of Risks

Recent global events have underscored the importance of being prepared for unforeseen circumstances. This limited-time offer serves as a reminder that having insurance is not just beneficial but essential.

Types of Free Insurance Available

While specific offerings may vary by provider, here are some common types of free insurance you might find:

1. Health Insurance

Many health insurers are offering free trial periods for their plans. This may include:

- Comprehensive medical coverage

- Preventive care services

- Emergency medical services

This is an excellent chance to evaluate the plan’s benefits and network without any initial financial commitment.

2. Life Insurance

Some life insurance companies provide free policies for a limited period, allowing you to secure coverage for your loved ones without immediate payment. This can be especially beneficial for young families or individuals with dependents who want to ensure financial security in case of unexpected events.

3. Auto Insurance

If you’re in the market for car insurance, several providers are offering free initial coverage for new customers. This can help you save money while ensuring that you’re protected on the road against accidents or damages.

4. Renters Insurance

For those renting their homes, some insurers offer free renters insurance for a limited time. This type of coverage protects your personal belongings against theft or damage, giving you peace of mind without any upfront costs.

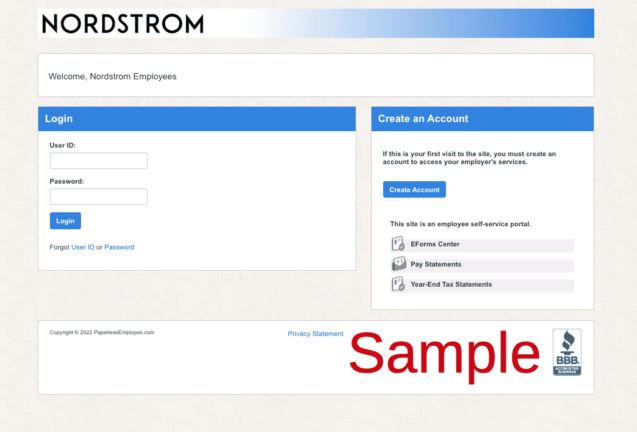

How to Take Advantage of This Offer

To make the most of this limited-time offer, follow these steps:

1. Research Providers

Start by researching reputable insurance providers that are currently offering free insurance promotions in your area. Look for companies with positive reviews and strong customer service ratings.

2. Compare Plans

Don’t settle for the first offer you encounter. Compare different plans based on:

- Coverage options

- Premiums after the free period ends

- Customer service quality

- Additional benefits (like wellness programs or roadside assistance)

3. Check Eligibility Requirements

Each provider may have specific eligibility criteria for their free insurance offers. Ensure that you meet these requirements before applying to avoid disappointment.

4. Read the Fine Print

Understanding the terms and conditions associated with the offer is crucial. Look out for:

- Duration of the free coverage

- Any potential hidden fees

- Obligations once the free period ends (e.g., automatic enrollment into a paid plan)

5. Apply Promptly

Since this is a limited-time offer, don’t delay! Apply as soon as possible to secure your free coverage before it’s too late.

What Happens After the Free Period?

Once the promotional period ends, it’s important to know what comes next:

- Transition to Paid Coverage: Be prepared for what your premiums will look like after the free period ends.

- Evaluate Your Needs: Use this time to assess whether you want to continue with the plan or explore other options.

- Cancellation Policies: Familiarize yourself with how to cancel if you choose not to continue with paid coverage.

Conclusion

Free insurance is an exceptional opportunity that can provide significant financial protection during uncertain times without any upfront costs. With various types of coverage available and no initial investment required, there’s no reason not to explore this limited-time offer.Take action today—research your options, compare plans, and secure the peace of mind that comes with being insured. Remember, opportunities like this don’t come around often; don’t let it slip away! Protect yourself and your loved ones by taking advantage of this incredible offer before it’s too late!